Self-Invested Personal Pension

Switch your pension on. Switch your future on.

Important information - This isn’t personal advice. If you’re unsure what’s best for your situation, please seek advice. SIPP investors need to be happy to make their own investment decisions and understand that all investments can rise and fall in value so although gains are possible, you could also get back less than you invest. Pensions are designed to help fund retirement and later life, so money can’t usually be taken out again until at least 55 (rising to 57 in 2028). Pension and tax rules can change, and their benefits depend on your circumstances. Before transferring check for loss of benefits and excessive exit fees.

What is a SIPP?

A Self-Invested Personal Pension (SIPP) is a type of account that allows you to take charge of your retirement savings. You have the freedom to invest exactly where you want to and control how much money goes in and when.

You have all the same tax advantages as a traditional pension, and the government will still give you a boost of up to 45% (or 48% if you're a Scottish rate tax payer) on top of anything you pay in as tax relief.

You can even use a SIPP to combine all your old pensions into one easy-to-use online account. And take money out from age 55 (rising to 57 from 2028).

Remember, pension and tax rules can change and any benefits will depend on your circumstances. Investments can rise and fall in value, so you could get back less than you pay in.

Join over 500,000 clients already using the HL SIPP

- Flexible payments - Monthly direct debits from as little as £25 a month, with the ability to pause or cancel payments if you ever need to. View SIPP charges.

- Expert knowledge and guidance - Get the latest investment news, research and insight. Plus tools to help you make decisions with confidence.

- Invest where and how you want to - You can pick your own investments, select our ready-made pension plan, or pay a financial adviser to choose investments for you.

- Trusted by 1.8 million clients - We’re a financially secure FTSE-listed company, authorised by the Financial Conduct Authority. And have won over 200 awards.

- Freedom at retirement - With the HL SIPP, you're free to choose from all the main retirement options.

- Ongoing support - Help from our UK-based client support team. Or personal financial advice from our highly qualified experts.

Two simple ways to open a SIPP

Start with a bank payment

Set up monthly payments from as little as £25, or make one-off payments of £100 or more.

You can change your pension contributions whenever you like.

Transfer your old pensions

Transferring pensions from another provider, including old workplace pensions, can help you to take control of your retirement savings.

The fastest way to transfer is online.

The HL Ready-Made Pension Plan is a really attractive investment solution for me. After a bit of research, I was convinced to invest and commit for the long term.

Khalid recently invested in the HL Ready-Made Pension Plan. A simple low-cost investment solution managed by HL experts.

I just think HL are a really good company. I think they’re switched on. They know what they’re doing. They’re a trustworthy company. There’s just something about them that makes you feel safe.

Lynne uses HL insights to help her manage her pension. She’s able to keep on top of her HL Self-Invested Personal Pension (SIPP) with ease and likes the wide range of investment options.

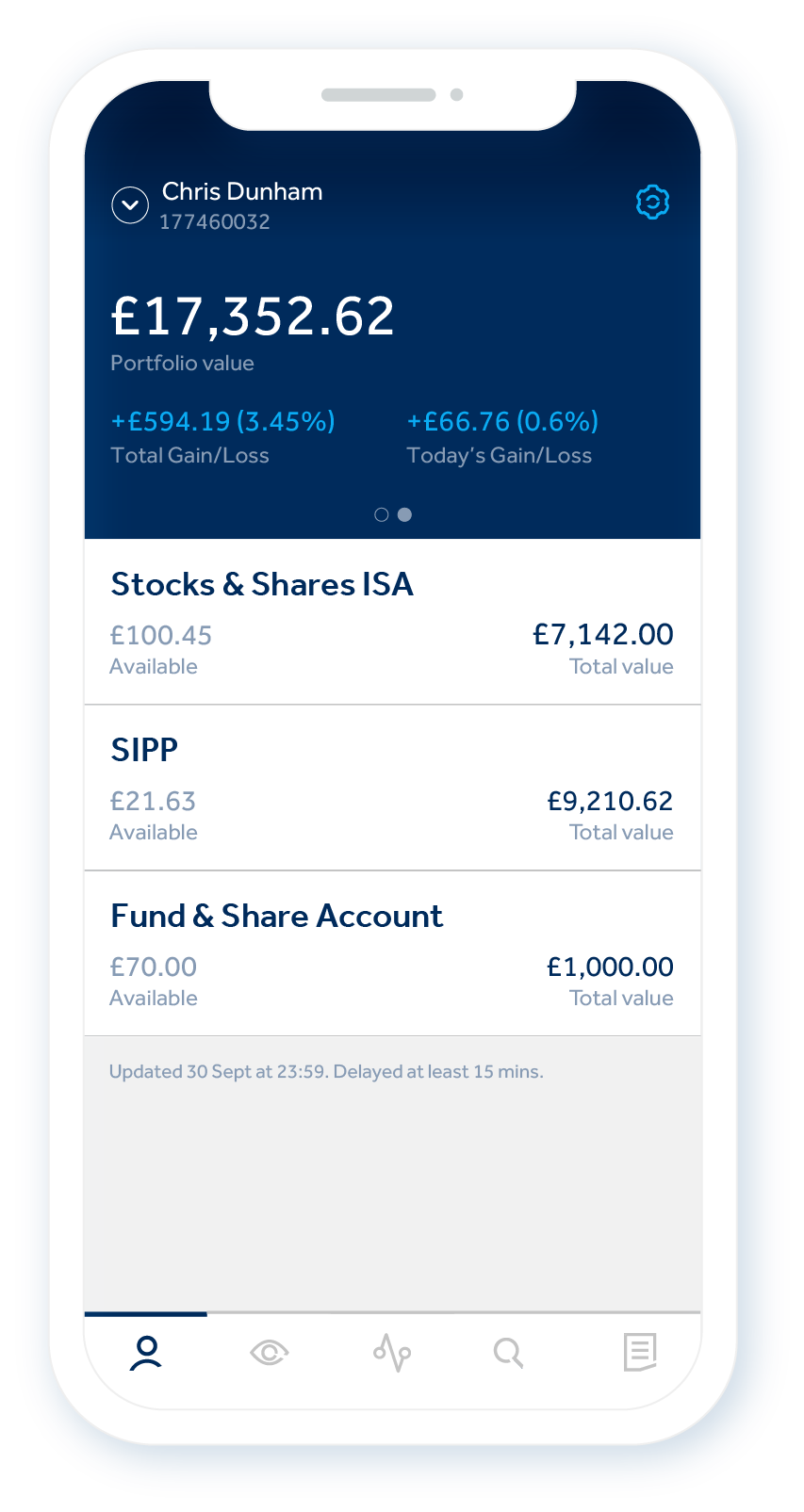

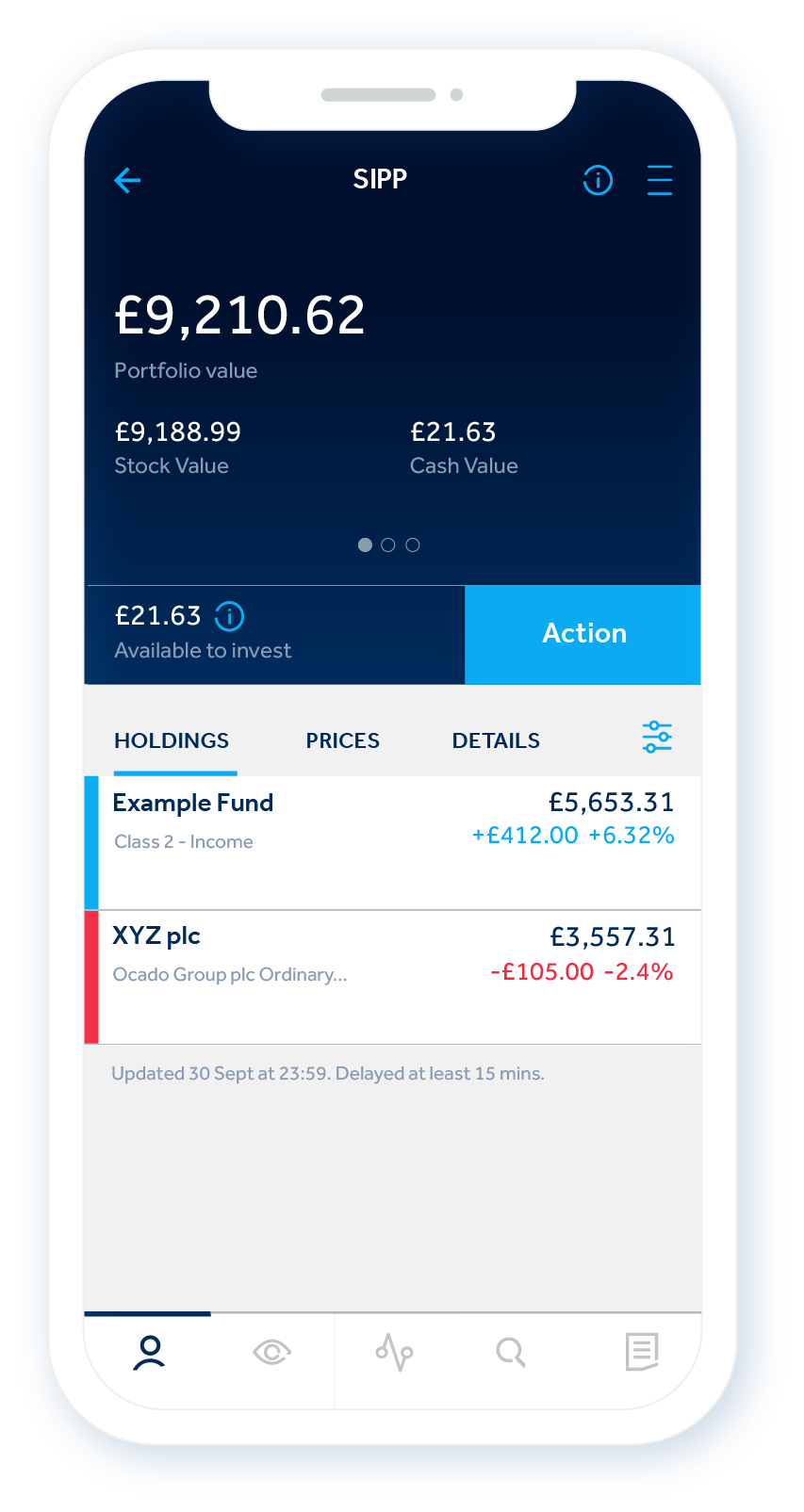

YOUR PENSION IN

YOUR POCKET

The HL app

-

Fast, secure account access

Log in to your account securely using fingerprint login and Face ID on iPhone.

-

Your investments at a glance

It's easier than ever to see your investment performance and if your pension's on track.

-

Place deals on the go

Buy and sell investments, even on the move.

Want to learn more?

Discover everything you need to know about SIPPs, including the risks and benefits, in our easy-to-read guide.

Best Online

Stockbroker

3 Years Running

The Personal Finance

Awards 2023/24

Best Buy Pension 2024

Boring Money Awards

Best Investment App 2024

Boring Money Awards

Apple, the Apple logo, Face ID and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries. Android, Google Play and the Google Play logo are trademarks of Google Inc.