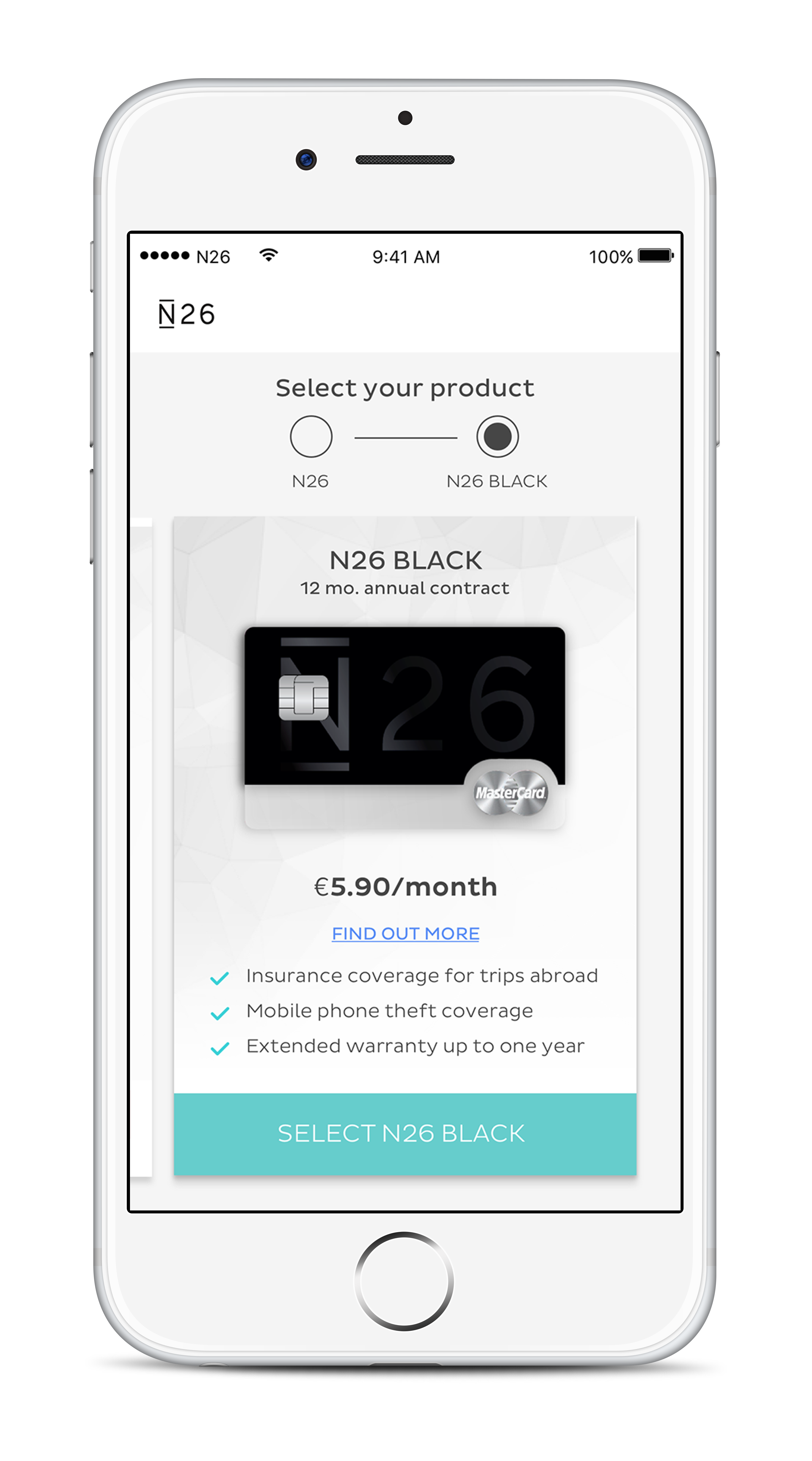

What’s missing from N26? The company has been slowly but surely building a new bank account from the ground up. This time, the company is trying to recreate the insurance product that you typically get with a Visa Premier or MasterCard Gold. So N26 is launching the N26 Black card.

The startup has been working with an insurance company directly and is now able to provide the same kind of insurance contracts that your bank provides when it tries to sell you a premium MasterCard (Gold, World Elite, etc.). Soon, N26 users will be able to upgrade their cards to an N26 Black card. This is more or less the same card with the same features in the N26 app, but it comes with insurance coverage from Allianz.

For €5.90 per month with a one year commitment ($6.40 per month), you get more or less the same kind of coverage that you get with a premium MasterCard or Visa card in a traditional bank. Allianz will cover the hospital expenses if you need to go to the hospital while traveling abroad. The insurance company will also pay back expenses if your flight has been delayed by more than 4 hours. And you can also expect a compensation if somebody steals your phone.

As the full documentation of the insurance isn’t live yet, we don’t know yet if there will be some sort of ski insurance and rental car insurance. Customers also expect an insurance on these fronts with their premium payment card but it could be included.

The nice thing is that you’re not forced to pay for an insurance product you don’t need. If you don’t use your N26 account that often, you can still choose the free N26 card. Customers in Germany, Austria and Ireland will be able to get the N26 Black card in early November. French, Italian and Spanish customers will follow a couple of weeks later.

Interestingly, the startup obtained a full banking license this summer. The company plans to switch its 200,000 customers to its own banking infrastructure in the coming weeks. It means that customers will get a new card and a new bank account number.

So N26’s user base will have the option to get a new basic MasterCard or the new N26 Black card. It seems like a smart move to launch the premium offering right before all customers request a new card. It’s going to improve the conversion rate to the N26 Black card.